Average Car Interest Rate

Super prime 781 to 850.

Average car interest rate. In fact the average interest rate on both a 48 and 60 month car loan from a commercial bank in the third quarter of 2019 was 5 27 according to the federal reserve. Interest rate by loan term. Cars and truck loans in singapore commonly bill level rates of interest suggesting rate of interest payment is a consistent amount every month over the life of a loan. Average interest rate for a new car loan.

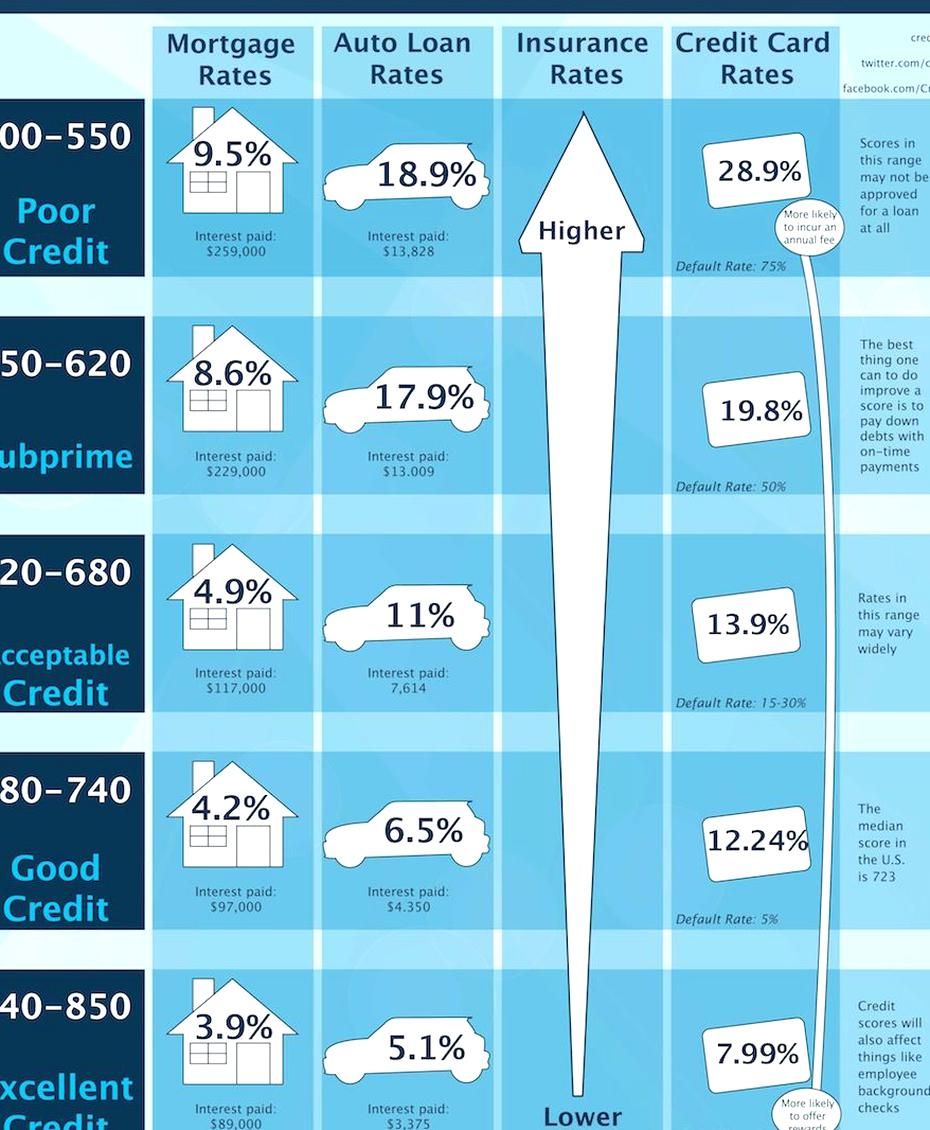

However if you have average or poor credit minor differences can make a big difference when lenders determine your interest rate. Credit scores of 719 for a new car or 655 for a used car or higher will help you qualify for the lowest auto loan interest rates. Compare auto loan rates. Because fico doesn t share or sell the fico auto score to consumers it s only possible to show the average rate of a car loan using a typical credit score.

The interest rate you get can also depend on your car s loan term though not always. The average auto loan interest rate in the last quarter of 2019 was 5 76 for a new car and 9 49 for a used car according to experian data. A good strategy if you get one of these loans is to make all of your payments for a year or so then refinance at a lower rate since you can show a track record of making. Here are the average interest rates on auto loans for new cars at the end of 2019 according to the state of the auto finance market report from the credit bureau experian.

Even if your credit score is lower you may still qualify for. At 15 72 the average new car interest rate we found for people with poor credit the total interest comes to 12 965. Car loan interest rates today you can utilize our auto loan calculator to see which alternative produces the ideal outcome for your needs. Average auto loan rates by credit score.

Average used car loan interest rates in august 2020. The national average for us auto loan interest rates is 5 27 on 60 month loans. Average interest rates by credit score. Prime 661 to 780.

That s more than a third of the car s purchase price of 36 000 and about 9 000 in added costs compared to what someone with excellent credit would pay. See rates for new and used car loans and find auto loan refinance rates from lenders. For individual consumers however rates vary based on credit score term length of the loan age of the car being financed and other factors relevant to a lender s risk in offering a loan. Nonprime 601 to 660.