Virginia Car Sales Tax

Vehicle sales and use tax is 3 of the sale price.

Virginia car sales tax. Motor vehicle sales and use tax. If you sell lease distribute or rent tangible personal property to customers in virginia or otherwise meet the definition of a dealer and have sufficient activity in virginia you have nexus as defined in va. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. So if your car costs you 25 000 you multiply that by 3 to get your tax amount of 750 00.

An additional 64 fee applies to electric vehicles excluding mopeds. Effective july 1 2016 unless exempted under va. This will be a continuous tax to figure in your costs. During the titling process the state takes either the 4 15 rate or 75 depending on which one is higher.

Motor vehicle sales and use tax. This will depend upon the value of the car at the first of the year. Effective july 1 2016 unless exempted under va. What is virginia s sales and use tax.

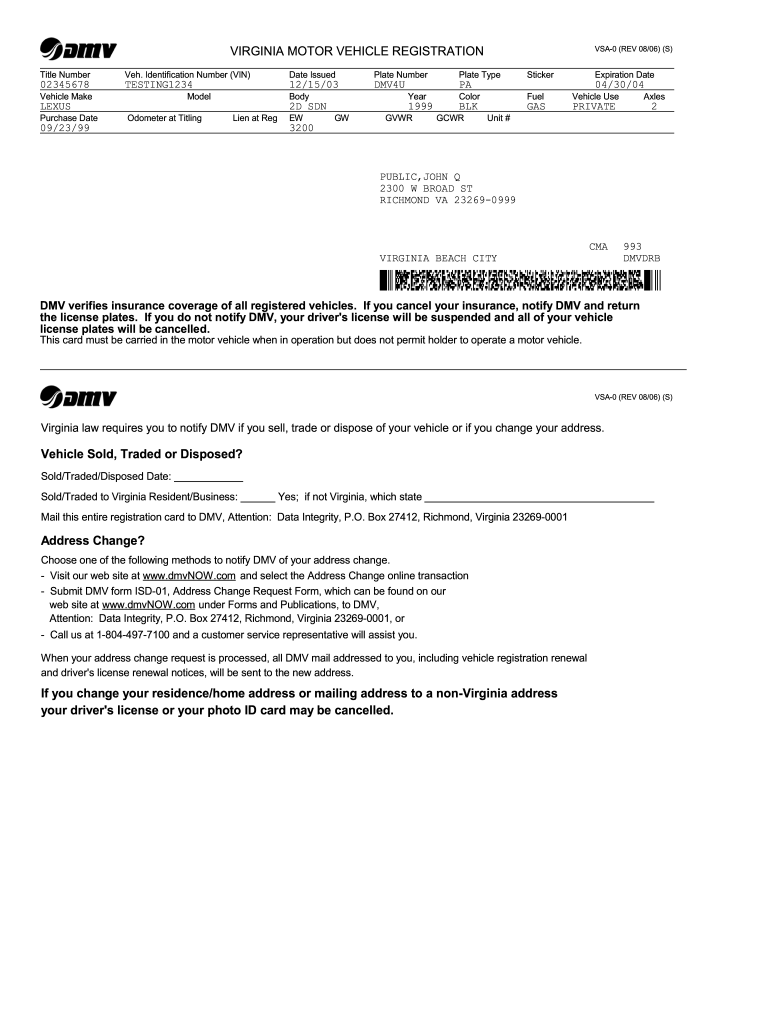

This one time tax is based on 4 15 of a vehicle s gross sales price and is charged whenever a vehicle changes ownership. You can find these fees further down on the page. In addition to taxes car purchases in virginia may be subject to other fees like registration title and plate fees. Code 58 1 612 and must register to collect and pay sales tax in virginia.

Do virginia vehicle taxes apply to trade ins and rebates. Virginia collects a 4 00 state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. Virginia taxes your automobiles every year as a property tax. Code 58 1 2402 virginia levies a 4 15 motor vehicle sales and use sut tax based on the vehicle s gross sales price or 75 whichever is greater.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. For the purposes of the motor vehicle sales and use tax collection gross sales price includes the dealer processing fee. Find your state below to determine the total cost of your new car including the. For the purposes of the motor vehicle sales and use tax collection gross sales price includes the dealer processing fee.

The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within state lines with the minimum sales tax for purchased vehicles. Calculating sales tax summary. Effective july 1 2016 unless exempted under va. During the titling process the state takes either the 3 rate or 35 depending on which one is higher.

Motor vehicle sales and use tax. Code 58 1 2402 virginia levies a 4 15 motor vehicle sales and use sut tax based on the vehicle s gross sales price or 75 whichever is greater.