Used Car Loan Interest Rate 2020

The interest rate you get can also depend on your car s loan term though not always.

Used car loan interest rate 2020. Updated april 13 2020 by yowana wamala. By refinancing your loan with your improved score you may be able to lower the interest rate on your auto loan significantly. These loans include fixed rates mechanical repair coverage and a simple interest method that allows you to pay less over the length of the loan. Bank of america auto loans are available in all 50 states.

In fact the average interest rate on both a 48 and 60 month car loan from a commercial bank in the third quarter of 2019 was 5 27 according to the federal reserve. Other factors that impact your auto loan rate are the type and length of the loan. Interest rate by loan term. At the time of publication fixed rates are as low as 2 99 percent apr for a new car from a dealer 3 49 percent apr for a used car from a dealership and refinance rates are as low as 3 99 percent apr.

Student loan interest rates auto loan rates. While some lenders may charge lower rates for a longer term others like credit unions offer higher rates on. However ccu requires you to pay a fee of 5 and keep at least that much in a savings account. Used car loans have a higher interest rate than new car loans because used cars have a lower resale value than new cars.

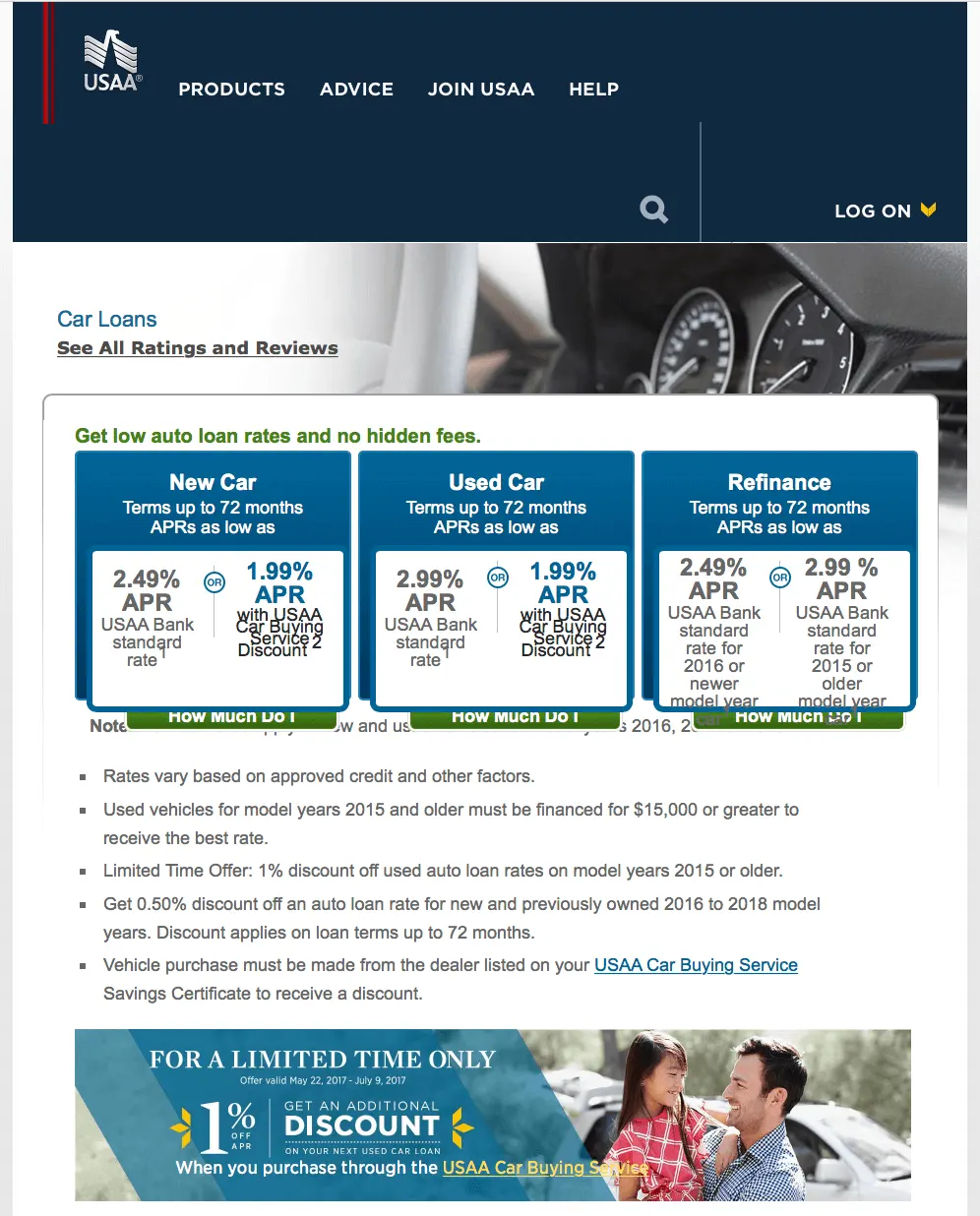

In return you can get auto loan rates as low as 2 99. For individual consumers however rates vary based on credit score term length of the loan age of the car being financed and other factors relevant to a lender s. If you default on a used car loan the lending company will be left with a lower value asset to sell. The national average for us auto loan interest rates is 5 27 on 60 month loans.

But consumers with good credit will find 2020 car loan rates comparable. 2020 facts figures. Average auto loan interest rates.