Minimum Credit Score For A Car Loan

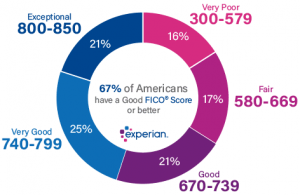

The average credit score for a new car loan in 2017 was 721 and 641 for a used car loan.

Minimum credit score for a car loan. A score of 650 on a scale of 300 to 850. Your credit scores can affect your ability to get a car loan and the interest rate you may be offered. There is however a correlation between higher scores and lower interest rates. Lenders and dealers guaranteeing a loan or not requiring credit checks will often have.

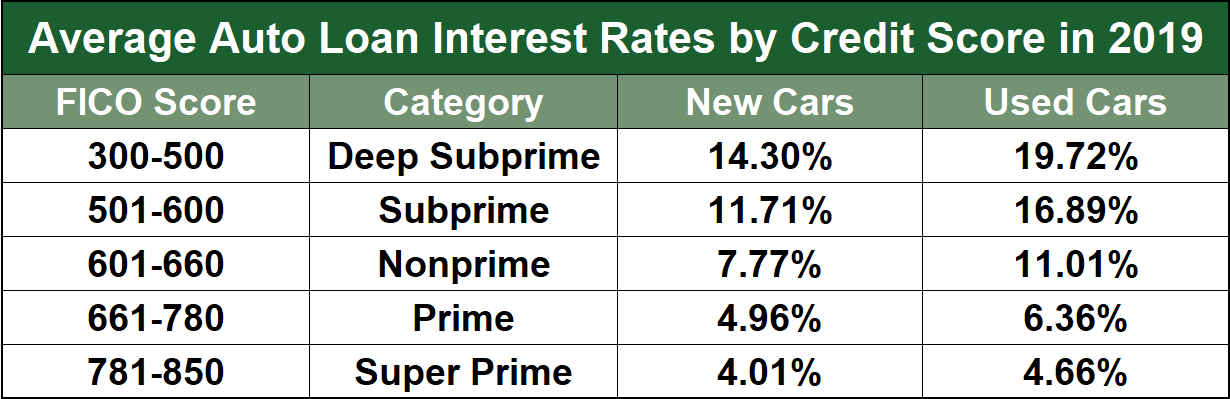

When it comes to applying for a car loan the better your credit score and your financial history the better the rate and terms you ll qualify for. Buying a new car or a used one is a big financial cost and for most people getting some form of a loan is necessary. What is the minimum credit score needed for a car loan. The average car loan interest rate for people with a fair credit score of 650 699 is 11 69 for a new car and 11 94 for a used car.

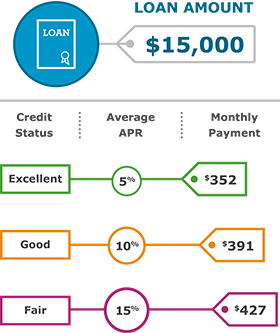

Running the numbers this means someone with a fico score in the 500 range may pay 10 000 more in interest over the life of a 5 year 30 000 car loan than someone with an excellent credit score. The cut off point for a prime car loan approval is a credit score between 620 650 630 typically car loan approvals for people with lower credit scores are available at slightly higher interest rates. Auto loan interest rates vary by the buyer s credit score whether the car is new or used how long it will take for the loan to be repaid and the specific lender. However the range of credit scores among people who purchased a car in 2017 runs the gamut so you can still get a loan with a lower than average score but the terms might not be as great.

Credit score has the biggest. Ultimately the credit score you need to get a loan is determined by the lender. Poor credit 450 649 subprime borrowers are those people with poor credit scores of 450 649 average an interest rate of 17 08 for a new car and 17 33 for a used car. The table below shows the average interest rate for new and used car loans based on credit scores according to experian data from the first quarter of 2020.

All credit scoring models including those built specifically for auto lenders use higher scores to indicate greater creditworthiness. Credit score requirements for your auto loan in 2019. But if you don t have a great track record with borrowing money it can be difficult to get credit. But it goes without saying that any given numerical score could mean different things on different scoring ranges.

Different lenders have different criteria for what they consider a minimum score that will green light a car loan but there are some ballpark numbers to be aware of. The good news is that there is no universal minimum credit score needed to obtain a car loan.