How Much Is Car Tax

It was introduced in 1937 and replaced the old system of road tax which traces its roots back to the taxation of hackney carriages in the 17th century.

How much is car tax. According to the money advice service zero emission cars still pay zero tax while vehicles which emit one. Vehicle excise duty ved also known as vehicle tax car tax or road tax is essentially a tax for using a vehicle on public roads. A recent reminder v11 or last chance warning letter from dvla. V5c 2 new keeper supplement document reference number.

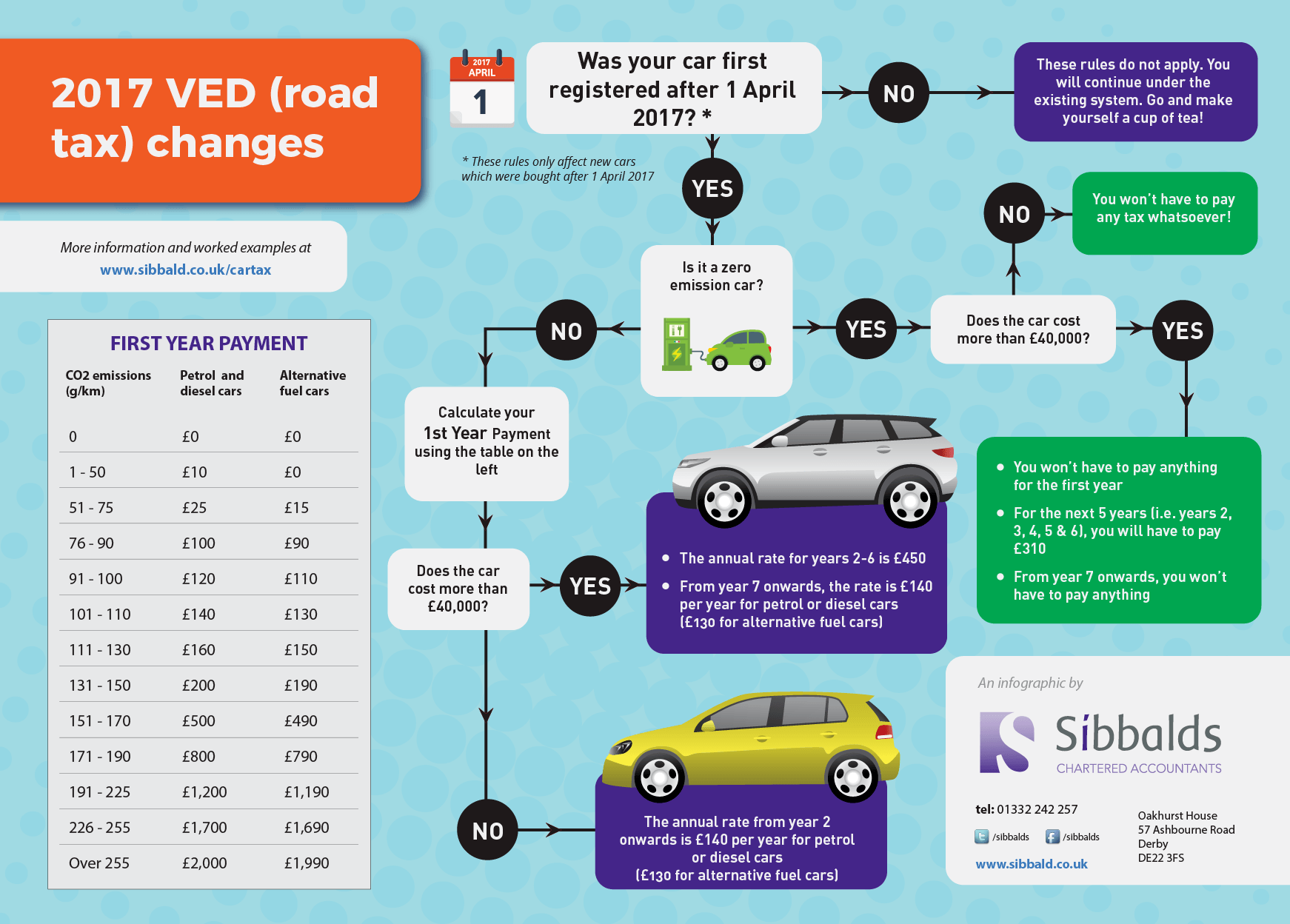

You ll need one of the following reference numbers to renew the tax for a vehicle online. 16 digit reference number from your v11 reminder. For cars registered before 1 march 2001 the rate of vehicle tax depends on its engine size. Car tax changes after the first year in the uk for vehicles which cost under 40 000.

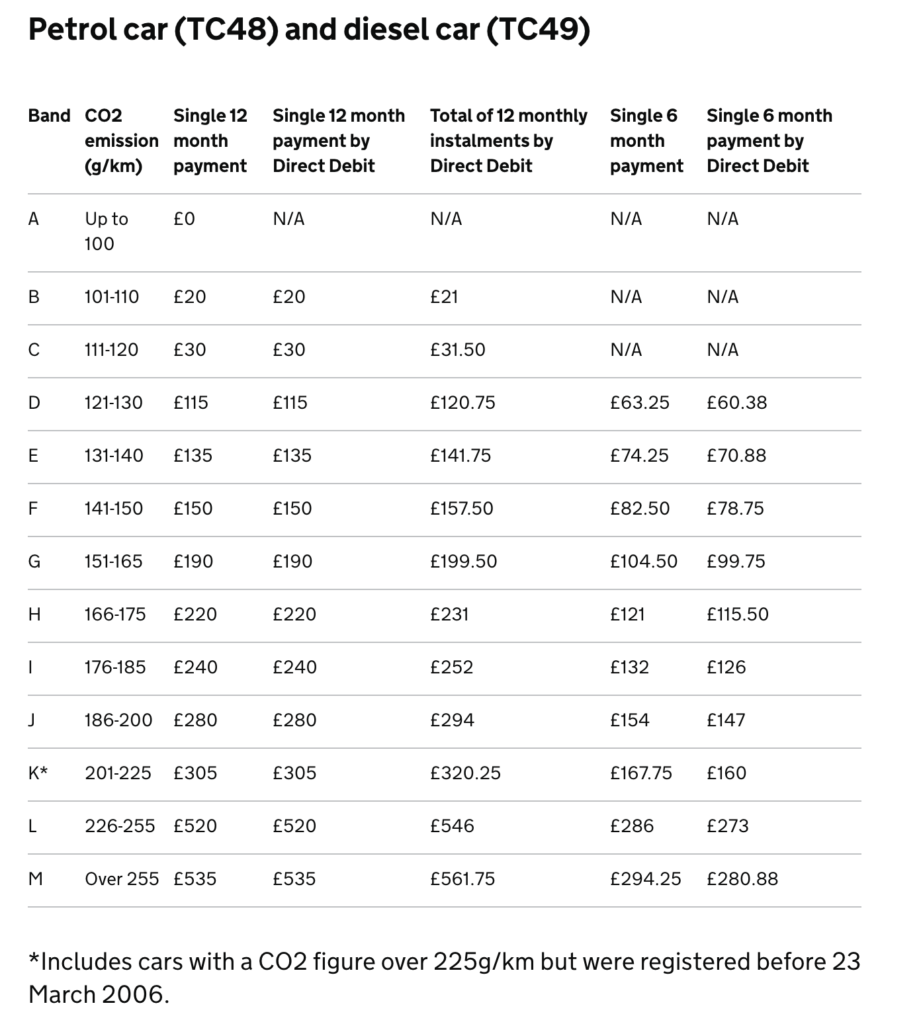

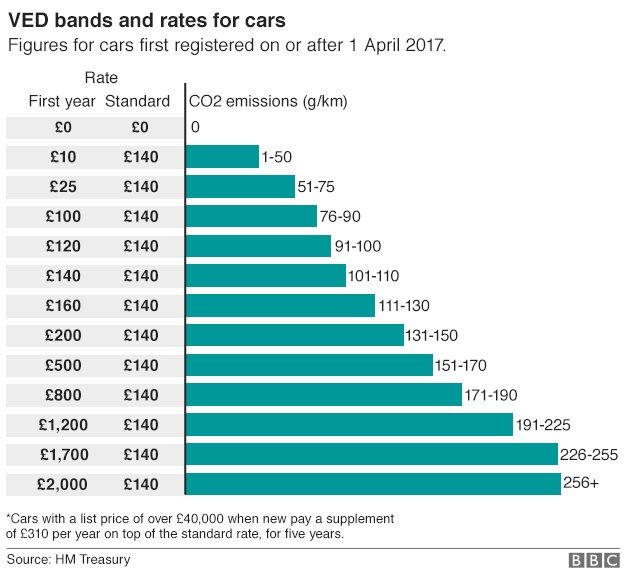

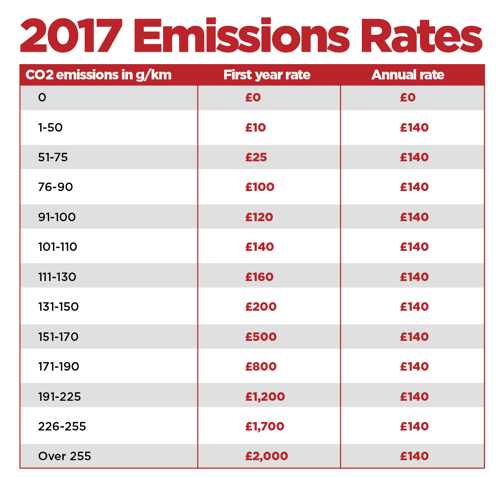

Other vehicle tax rates cars registered on or after 1 april 2017 you ll pay a rate based on a vehicle s co2 emissions the first time it s registered. The rate for cars registered on or after 1 march 2001 depends on co2 emissions and fuel type. How car tax is calculated. How much you pay in car tax depends on the make and model of your car how environmentally friendly the government thinks it is and how old your car is.

To understand the recent changes to car tax rules it helps to split things into three camps. Tax your car motorcycle or other vehicle using a reference number from. Your vehicle log book v5c it must be in your name. After the car s first year for cars with a list price below 40 000 the road tax costs are change.

You can tax a vehicle online using the dvla service. Renew your vehicle tax. V5c document reference number. The rate of vehicle tax is based on fuel type and co2 emissions.

Current rules for car tax or vehicle excise duty ved are based on a vehicle s official tail pipe co2 emissions and list price. There are thirteen co2 tax bands which relate to different emissions levels and amounts of car tax payable.