How Much Car Can I Afford On 70k Salary

The house affordability calculator will estimate how much home you can afford if you make 70 000 a year with options to include property tax home insurance hoa fees and more.

How much car can i afford on 70k salary. If your yearly salary is different check out this page. Don t waste your money. Cheat sheet on how much car you can afford. Your monthly car payment should be no more than 25 of your monthly net income.

Make your 70 000 go further. Rule of thumb if you have no debt is to buy a car that is no more than half of your annual income. 80 000 salary 16 000 car. That is how much you bring home each month after taxes.

If you re leasing or buying used. In your quest to establish the monthly amount you can afford to put into a new car you need to first determine your net monthly income. 140 000 salary 28 000 car. Amount of money for a down payment and closing.

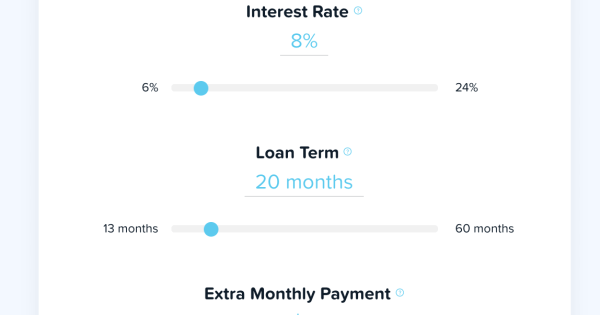

Let s break down how everything factors in. I was 19 000 over which explains why. We have lots of good tips on how to not waste your money. According to this rule when buying a car you should put down at least 20 percent you should finance the car for no more than 4 years and you should keep your monthly car payment including your principal interest insurance and other expenses at or below 10 percent of your.

That means when i purchased my 28 000 car i should have spent 9 000 instead based on my 45 000 salary x 20. 40 000 salary 8 000 car. 200 000 salary 40 000 car. Average 630 689 after plugging in these numbers homelight estimates that you can afford a home that costs 275 218 with monthly payments of 1 850.

Find out the monthly payment so you know what kind of mortgage on 70k salary you can afford. The rule of thumb when it comes to smart auto financing is the 20 4 10 ratio. If you make 70k a year i would look at cars in the 25k 35k range. How much house can i afford with my salary.

If your employer issues you a w 2 form each year your net income is fairly simple to calculate because your employer does it for you. There s no perfect formula for how much you can afford but our short answer is that your new car payment should be no more than 15 of your monthly take home pay.

:max_bytes(150000):strip_icc()/GettyImages-987375510-5e5a3676bb8a4bdaad3f55aa9fdb387b.jpg)