How Much Car Can I Afford For 300 A Month

The remainder is how much you can spend on a car payment.

How much car can i afford for 300 a month. The three rules of car financing. Those pencil out to 120 a month for fuel and about 140 a month for auto insurance which means john s total monthly automotive expenses are actually 802 or 25 of his monthly take home pay. And factoring in down payment and trade in calculates the loan amount and loan schedule you will need to make up any difference. How much of a car payment can i afford typical frugal shoppers will assess their monthly income take out taxes and spend around 10 15 on a car payment however the average car buyer spends 20 25 and some car fanatics can go as high as 50.

The amount above is calculated based on assumptions about what interest rate you can get and how long you want to finance the car for. Generally though they charge around 300. You can read our article on why you should pay an admin fee here. If you earn 50 000 per year and pay 20 of that in taxes your actual annual take home pay is 40 000 per year or 3330 per month.

The total price of the car you can afford is as follows. Hopefully we have cleared a few things up about leasing. For example after taking a look at your income and debt the bank may decide you can spend 370 a month on your car payment. Based on a 60 month term with an interest rate of 4 25 you can purchase a car with a price tag of 21 000 not a bad amount.

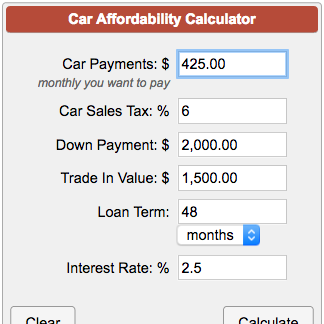

How much you want to spend a month. For example let s say you take home 3 500 per month. Use this calculator to find out how much car can you afford to buy. If you have a 700 student loan repayment every month you can reasonably spend about 450 each month on a car payment.

It also helps during negotiations with a dealer. So yes the chances are you can afford a lease car. You may have asked yourself. The rule of thumb when it comes to smart auto financing is the 20 4 10 ratio.

While it may seem like a lot of money there is reason behind it. On this page we calculate how much car you can get if you can afford to pay 300 month in principal and interest to cover a car loan. According to this rule when buying a car you should put down at least 20 percent you should finance the car for no more than 4 years and you should keep your monthly car payment including your principal interest insurance and other expenses at or below 10 percent of your. Knowing how much car you can afford to lease is important if you aren t familiar with how lease payments are calculated.

But before you can use this calculator to help determine how much car you can afford you ll need to know your budget including both your income and expenses.