California Car Sales Tax Calculator

Calculate used vehicle fees.

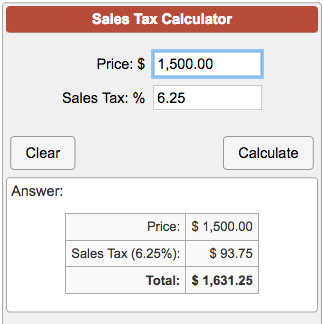

California car sales tax calculator. This means that depending on your location within california the total tax you pay can be significantly higher than the 6 state sales tax. California city county sales use tax rates effective july 1 2020 these rates may be outdated. California statewide sales tax on new used vehicles is 7 25. Some areas have more than one district tax pushing sales taxes up even more.

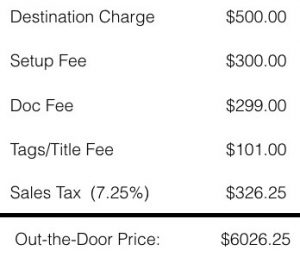

Enter the following information to determine used vehicle purchase fees. These fees are separate from the taxes and. Fees are calculated based on today s date. Estimated tax title and fees are 1000 monthly payment is 405 term length is 72 months and apr is 8 shop cars by price under 10 000 under 15 000 under 20 000.

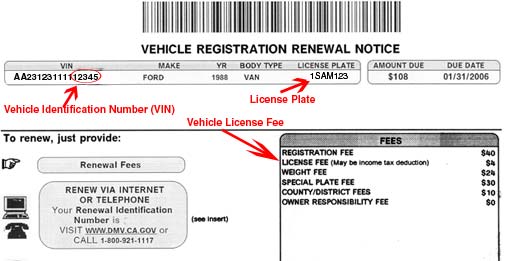

The sales tax is higher in many areas due to district taxes. Average dmv fees in california on a new car purchase add up to 244 1 which includes the title registration and plate fees shown above. The vehicle license fee is the portion that may be an income tax deduction and is what is displayed. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

Find your state below to determine the total cost of your new car including the car tax. If you purchase a vehicle for 12 000 and traded in your old. California documentation fees. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

Just enter the five digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to california local counties cities and special taxation districts. For a list of your current and historical rates go to the california city county sales use tax rates webpage. In california the sales tax will not account for the amount you received when trading in your vehicle says the sales tax handbook. Vehicle license fee may be an income tax.

Your annual vehicle registration payment consists of various fees that apply to your vehicle. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. California has a 6 statewide sales tax rate but also has 509 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2 388 on top of the state tax.

/buying-a-car-in-a-different-state-4148015-Final2-1a901895477c4c518d48407644568ce8.png)